Excel Salary Slip Format Download.xls. Excel Salary Slip Format Download.xls. Pay Slip or Salary Slip template in excel is the receipt given by the employer to their employees every month upon payment of salary to the employee for the services rendered in the month. Pay Slip consists of all kinds of earnings and deductions under various heads as per the norms are given by the government in the respective financial year. Free Salary Slip Format In Excel With Formula These particular salary slips are designed in MS Excel with the formula that can help out to make a professional simple salary slip. It is another design of a salary slip template. It has been established in MS word.

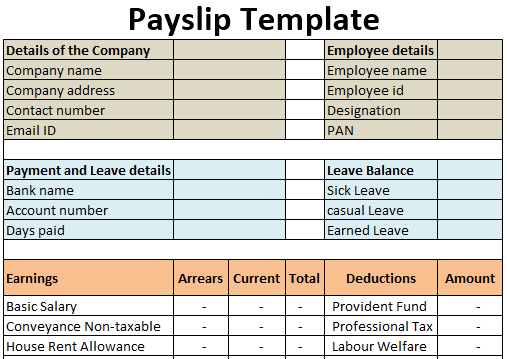

Salary slip is also called Payslips. Salary slips consist of the salary details of the employees, which include earnings like basic wage, HRA, Conveyance allowances, medical allowances, special allowances, and deductions like EPF, professional tax, TDS, loan recovery details.

If you are an employer then it is always better to issue a simple salary slip format to your employees, so that they can easily understand their gross wage, gross deductions, and net salary details.

Along with salary components, it is better to include other details like employee id, bank account number, UAN, ESI number, etc. Here you can find some simple salary slip formats which you can download in Excel, Word, and PDF formats.

Salary Slip Format 1

Salary Slip Format 2

Salary Slip Format 3

Important Components on Salary Slip

Useful Salary Slip Formulas

FAQs

1. How can I get my salary slipYou can get your salary by asking your employer, it is the right of every employee to get salary slip whenever they want.

2. What is the use of salary slipSalary slip/pay slip acts as an income proof, which is required for various loans and especially when you are trying to join in new with better salary package.

3. How to verify my salary slipIf you know some basic formulas of salary calculations, then you can easily verify your salary slip yourself. Otherwise take help of anyone who knows about it.

4. Can HR verify salary detailsYes, HRs will definitely verify your salary details. It is their duty to verify the salary details of the existing employee and new joiners ( during background verification)

5. Can I edit my salary slip

5. Can I edit my salary slipYou can edit your salary slip in excel or PDF formats. But don’t manipulate your salary details on your payslips, it may cause problems.

6. What to do you do if you don’t have a payslip

If you don’t have any pay slip then you can download above pay slip formats and update your salary details. (make sure the salary you mentioned in payslip should match with the salary credited in your bank account).

Or Take help from your company HR or Account department.

Salary Sheet Format In Excel

Yes, they will see your old salary. For that they will ask you to submit your previous company payslips.(At least for last 3 months)

8. It is Ok to lie about my current salary in interviewIt is not a good idea, why because once you selected then they will ask you to submit your previous job pay slips.

9. How can I prove my income without salary slip

9. How can I prove my income without salary slipYou can show your bank statement, or form 16, your job offer letter or appointment letter.

Also Read

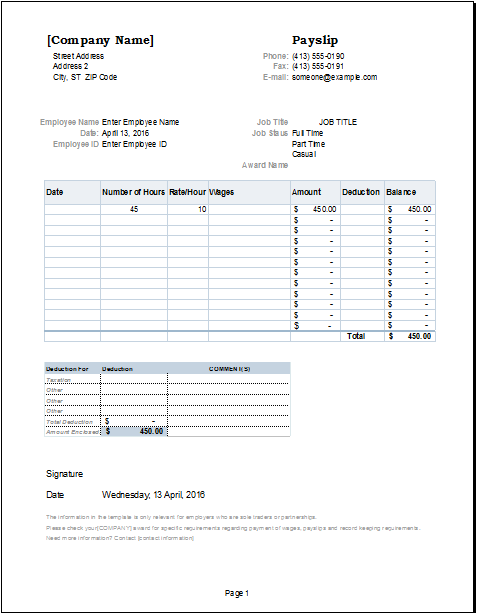

A payslip is a statement that businesses provide to their employees with each payment they receive. This payslip informs the employee of their gross pay and what deductions were taken out to arrive at their net pay. It also provides an additional way for both the employer and employee to keep a record of their finances. In many countries, a payslip is required by law. It is typically easier and recommended to use an accountant or payroll company for your business's employee payments and payroll fulfillment.

The information required on a payslip or pay stub differs by geographic location. This Payslip Template for Excel was designed for businesses based in the UK, but may be modified to suit other locations as well.

Download

⤓ ExcelLicense: Private Use (not for distribution or resale)

'No installation, no macros - just a simple spreadsheet'

Description

This Payslip Template includes very distinct sections. The top is for company and employee details. The top right is for payment details as well as a message section where you can include additional details like how many vacation days your employee has left.

The Earnings section lists the hourly pay and the other payment amounts, broken down by category.

The Deductions section lists the taxes, insurance, and other amounts withheld or deducted from the gross pay.

The bottom of the payslip shows the Net Pay (Total Earnings - Total Deductions). The Net Pay should be the amount on the paycheck.

Some information in this payslip template that are specific to companies based in the UK include:

- Tax Code

- Employee Payroll Number

- National Insurance (NI) Number

- UK related earning & deduction types

Using the Payslip Template

Important ! Your country or location may have different payslip and pay stub requirements. So, we highly recommended that you contact a professional accountant to advise you on those requirements and to learn what categories of earnings and deductions you should be using.

Getting Started / Customizing for Your Business

- Edit the Company and Employee information in the header and footer of the Payslip tab.

- Edit the Earnings and Deductions categories in the YearToDate worksheet

- If you need more options for different types of earnings and deductions, unhide the hidden rows in the Payslip worksheet and the hidden columns in the YearToDate worksheet.

Entering Hours and Payment Amounts

Instead of entering amounts directly into the Payslip, you will update the YearToDate worksheet with the hours, rates, and payment amounts. Then, you select the Pay Date in the Payslip worksheet to update the amounts in the Payslip.

Salary Slip Format In Excel With Formula Xls

To make the YearToDate worksheet more concise, you can hide the columns that you aren't using.

Excel Number Format In Formula

What to do Each Pay Period

Salary Slip Format In Excel With Formula Free Download

- Enter a new row in the YearToDate worksheet. Enter the Pay Date, Pay Period, Hours, and Pay Amounts.

- Select the new Pay Date from the drop-down at the top of the Payslip worksheet. The hours and amounts should update automatically (using lookup formulas).

- Verify, print, and send the payslip with the check.

Note: This spreadsheet does not calculate taxes or other deductions automatically.

If payments are made electronically via ACH (Direct Deposit), then you may want to send the payslip via email as a PDF (if that is acceptable according to local laws). You can create a PDF of the Payslip worksheet in Excel by going to File > Save As and selecting .pdf as the file type.

After learning the legal requirements for your business payslip, adapt this template to match. You can then provide your employees with a printed and/or digital payslip. Again, check the laws for your location to see what documentation is required and how/when you are required to provide it to your employees.

References and Resources

- Running Payroll at www.gov.uk - Provides guidelines and requirements specific to the UK, including information about Payslip requirements.

- Understanding the different parts of a UK payslip at MoneyAdviceService.org.uk

- Payroll Basics at payroll.intuit.com